Get Ready for Taxes: What's new and what to consider when filing in 2023

Here's what's new and some key items for taxpayers to consider before they file their 2023 tax returns.

Watch Out for Holiday Scams: Protect Personal Information

With the holiday season now in full swing, the period presents a prime opportunity for identity thieves to try stealing personal financial information, which also could be used to potentially file fraudulent tax returns. People can face risks if they're shopping online and using publicly accessible Wi-Fi.

Cómo formar una Corporación en el estado de la Florida

¿Qué se necesita para abrir una corporación en el estado de la Florida? En este video Álvaro Acevedo explica en detalle los 3 pasos necesarios para la creación de este tipo de entidades, los cuales son recopilar los datos corporativos, enviarlos y hacer el pago ante el Departamento de Estado de la Florida.

¿Quiénes son residentes fiscales en EE.UU. y quiénes no?

¿Cuándo se paga impuestos en EEUU? ¿Qué pasa si no soy ciudadano estadounidense pero tengo negocios en ese país? ¿Si solo soy un estudiante o investigador, debo pagar impuestos por mis ingresos en otras partes del mundo? En este video el abogado tributario Alvaro Acevedo explica cuándo aplica el estatus de Extranjero y bajo qué condiciones se puede solicitar excepción.

Annual BVI Economic Substance Reporting

Depending on the date of incorporation, the Annual Reporting Obligation for BVI Companies must be submitted by November 15, 2022, or within 6 months after the end of the prior financial period.

IRS hired 4,000 to provide more help during 2023 tax season on phones

The IRS announced significant progress to prepare for the 2023 tax filing season as the agency passed a milestone of hiring 4,000 new customer service representatives to help answer phones and provide other services.

Meet Alvaro Acevedo | Board Certified Tax Attorney & Certified Public Accountant

We are happy to share this article on Alvaro Acevedo (our founder and leading attorney) about his route to success and what makes us a unique law firm.

Adjust tax withholding now to pay the proper amount of tax

IRS urges taxpayers to check their tax withholding while there's time left in 2022 to benefit from any necessary changes. An adjustment made now will help people avoid a big surprise, such as a big refund or a balance due, at tax time in 2023.

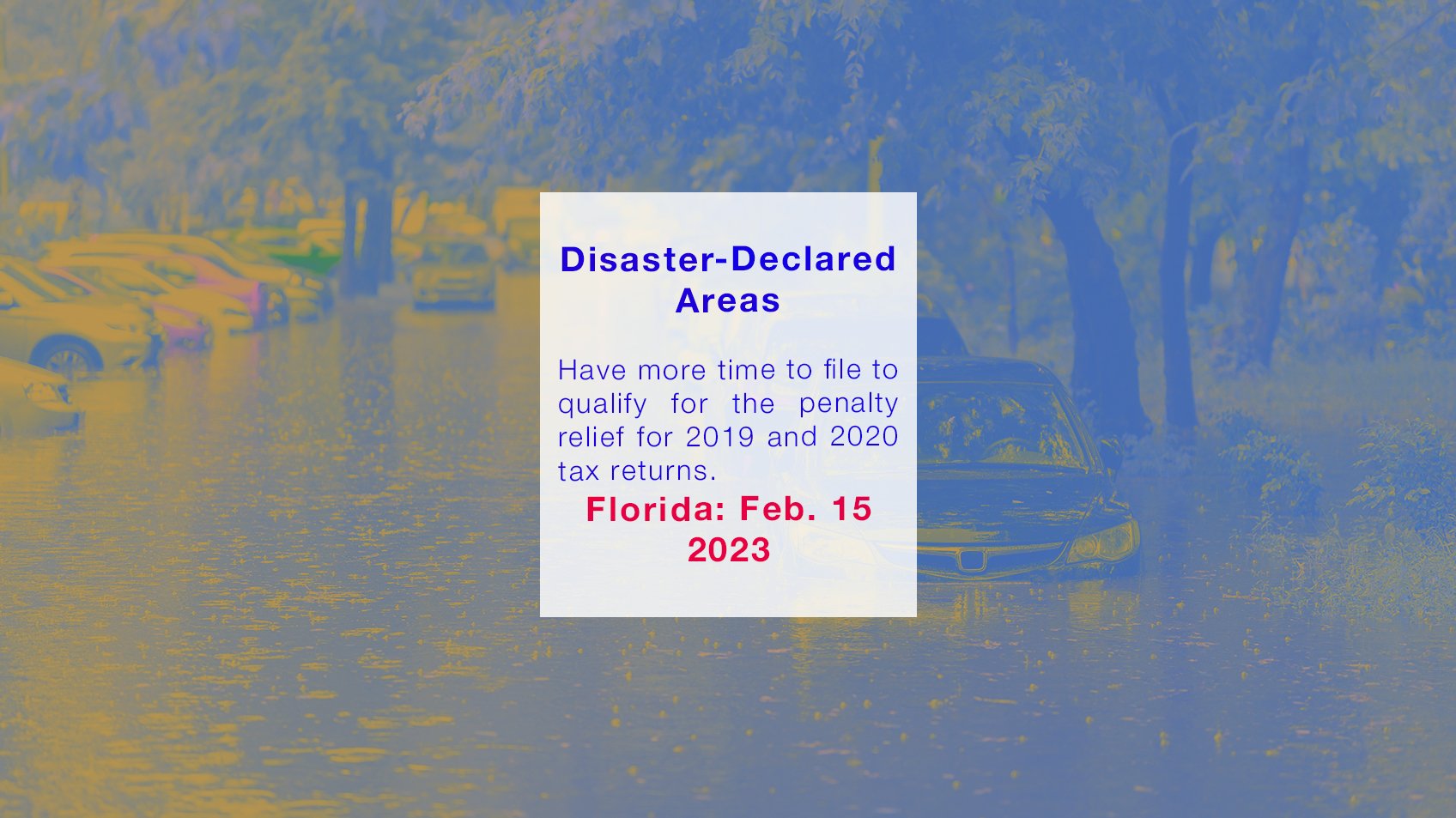

Deadline to file 2019 and 2020 tax returns to get COVID penalty relief postponed in declared disaster areas

Taxpayers in disaster-declared areas may have more time to file their returns to qualify for the penalty relief for their 2019 and 2020 tax returns.

FLORIDA’s DOR Reemployment Tax Due Date

Florida’s Employer’s Quarterly Report for July, August, and September 2022 is due. If you file and pay electronically, the deadline is October 28, 2022.

The IRS is sending over 9 million letters to potentially eligible families who did not claim stimulus payments

The IRS is sending letters to more than 9 million individuals and families who appear to qualify for a variety of key tax benefits but did not claim them by filing a 2021 federal income tax return. Many in this group may be eligible to claim some or all of the 2021 Recovery Rebate Credit, the Child Tax Credit, the Earned Income Tax Credit and other tax credits depending on their personal and family situation.

Victims of Hurricane Ian in Florida now have until February 15, 2023, to file various tax returns

Victims of Hurricane Ian that began September 23 in Florida now have until February 15, 2023, to file various individual and business tax returns and make tax payments

October 17 - 2021 Tax Return Deadline with Extension

Taxpayers who requested an extension to file their 2021 tax return to do so by Monday, October 17.

Sept 30 Deadline for IRS Penalty Removal

Today, 30th Sept 2022 is the deadline to file any tax return you haven’t filed yet for 2020 or 2019 to get an automatic penalty removal because of late filing. Pursuant to IRS notice 2022-36. For BUSINESS & INDIVIDUALS.

Reminder: File 2019 and 2020 returns by Sept. 30 to get COVID penalty relief

IRS reminds, struggling individuals and businesses, affected by the COVID-19 pandemic, that they may qualify for late-filing penalty relief if they file their 2019 and 2020 returns by September 30, 2022.

Tax Minute for 14 Sept

People who still haven’t filed a 2021 tax return should file electronically

Extension filers have until October 17 to file but filing electronically helps reduce processing time and correct errors.

+ A list of some of the most common errors taxpayers should avoid.

Tax Minute for Sept 12

September 15 deadline for third quarter estimated tax payments/ Tax relief for Mississippi water crisis victims/ 2021 tax extension filers don’t overlook important tax benefits & More

TAX Minute for Sept. 7

Deadlines for FLORIDA DEPT OF REVENUE, IRS’ NEWS & TIPS + TODAY’S CRIMINAL CASES.

Today’s Publications, Deadlines and New Forms

DEADLINES FOR TODAY:

IRS Deposit payroll tax for payments on Aug 27-30 if the semiweekly deposit rule applies. & FLORIDA DOR Pari-Mutuel (includes slot receipts) Cardrooms

NEW PUBLICATIONS + NEW FORMS